Law firms are subject to extensive oversight due to the sensitive data they collect from clients. Today, most client data is stored digitally, and law firms need to comply with a wide range of regulatory requirements.

Navigating legal compliance regulations can be tricky, especially when it comes to managing your digital systems and data online.

It’s important to be aware of these regulations and develop a compliance strategy, both to protect your clients’ data and to avoid fines from regulators.

In this article, we’ll dive into some of the data security regulations your law firm should be aware of and how to handle legal compliance challenges.

Key Takeaways

- Law firms are subject to very strict compliance laws. The exact regulations your law firm is subject to will depend on your industry and the type of cases you take on.

- Failing to meet compliance standards could result in fines as well as long-term damage to your reputation and your finances.

- Data privacy laws are a particularly big concern for law firms, as protecting sensitive client information is of the utmost importance.

- Investing in a strong cybersecurity strategy and employee training can help you maintain client privacy and prevent data breaches.

Understanding Compliance in the Legal Sector

Legal compliance is the process of adhering to the complex laws and regulations that apply to legal service providers. The legal profession is subject to stricter regulatory compliance than other industries.

This is because law firms often need to access and store sensitive data as part of their cases, and clients who are seeking legal help may be in vulnerable situations.

Compliance regulations are typically put in place to protect consumers who work with legal professionals.

These regulations also protect your business. They help you avoid devastating data breaches that can disrupt your operations and damage your reputation. The average cost of a data breach for professional services organizations is $4.47 million, which illustrates just how damaging these data breaches can be.

There are several components of law firm compliance to be aware of. Lawyers are required to maintain attorney-client privilege and cannot share information that has been disclosed to them by clients in confidence.

Client confidentiality is supported by strict data protection rules. This means that law firms must take steps to protect their clients’ data, whether it’s stored digitally or in physical documents.

This includes both sensitive case data, financial information, and personally identifiable information like birthdays and Social Security numbers.

Many law firms are also subject to strict financial and accounting regulations. In particular, law firms are subject to strict regulations for client trust accounts.

Major Compliance Regulations That Impact Your Law Firm

There are several compliance standards and laws that legal practices need to follow. Here are some of the most notable.

Sarbanes-Oxley Act

The Sarbanes-Oxley Act, or SOX, is a piece of legislation that is designed to prevent accounting fraud. It was passed in 2002 and is enforced by the Securities and Exchange Commission.

While this legislation primarily targets large, public corporations, there are many provisions that apply to law firms as well. It requires companies to adhere to certain accounting and record-keeping practices.

This law also created very strict criminal and legal penalties for people who are found guilty of securities fraud.

All publicly-traded companies need to comply with SOX, but it’s best practice for all firms to comply with this legislation, regardless of requirements.

Corporate compliance with SOX involves documenting your business practices, keeping accurate financial records, and completing audits on a regular basis.

GDPR

The General Data Protection Regulation, or GDPR, is a landmark data privacy law that was passed in the European Union in 2016. This law currently only applies to organizations within the EU.

However, it’s best practice for law firms internationally to follow the GDPR. This is because many local governments are considering implementing very similar data privacy laws.

The state of California has already passed the California Consumer Privacy Act, which is very similar to the GDPR.

To comply with the GDPR and other similar data protection laws, you’ll need company policies in place to protect the data you collect from clients.

You’ll also need to conduct regular risk assessments and have a response plan in place to ensure you’re properly prepared in the event of a data breach.

On top of that, you’ll need to be transparent with your clients about how data is collected and stored. You’ll also need to get clear consent before collecting certain types of sensitive data.

HIPAA

When you think of HIPAA compliance, you probably think of medical providers and healthcare organizations. However, law firms need to comply with HIPAA too if they work with protected health information as part of their cases.

This means that law firms need to have cybersecurity safeguards in place to protect digital health records. Law firms also need to get express written consent from clients in order to access these health records.

Anti-Money Laundering Laws

Some law firms may be subject to anti-money laundering (AML) laws, depending on the type of clients you serve and the cases you take on.

These laws are designed to prevent a variety of criminal financial activities, including money laundering, bribes, tax evasion, and other forms of fraud.

While not all law firms will be subject to anti-money laundering laws, it can still be helpful to establish AML compliance programs, especially for large and growing firms.

AML compliance laws require businesses to implement a system of internal controls specifically for preventing financial fraud. It also requires independent audits and risk assessments as well as ongoing employee training.

Data Protection and Privacy

Data privacy is becoming an increasingly important concern for law firms, particularly as operations shift online and records are stored digitally.

Law firms collect a wide range of sensitive data from their clients, ranging from personally identifiable information to financial data to confidential case-related information.

If your firm works with corporate clients, you may also access intellectual property as part of your work.

It’s essential to keep this sensitive data private and secure. Today’s clients are highly concerned about data safety—one study found that 86% of Americans cite data privacy as a top concern, beating out concerns about the US economy.

Putting strong data protections in place and being transparent about them can help you build trust with your clients and improve your reputation.

As previously mentioned, data protection is also essential for compliance. Depending on your location, you may already be subject to strict data privacy laws like the GDPR and its successors.

These requirements are ever-changing, so even if your firm isn’t subject to these restrictions yet, it’s still best to be prepared with strong data protections.

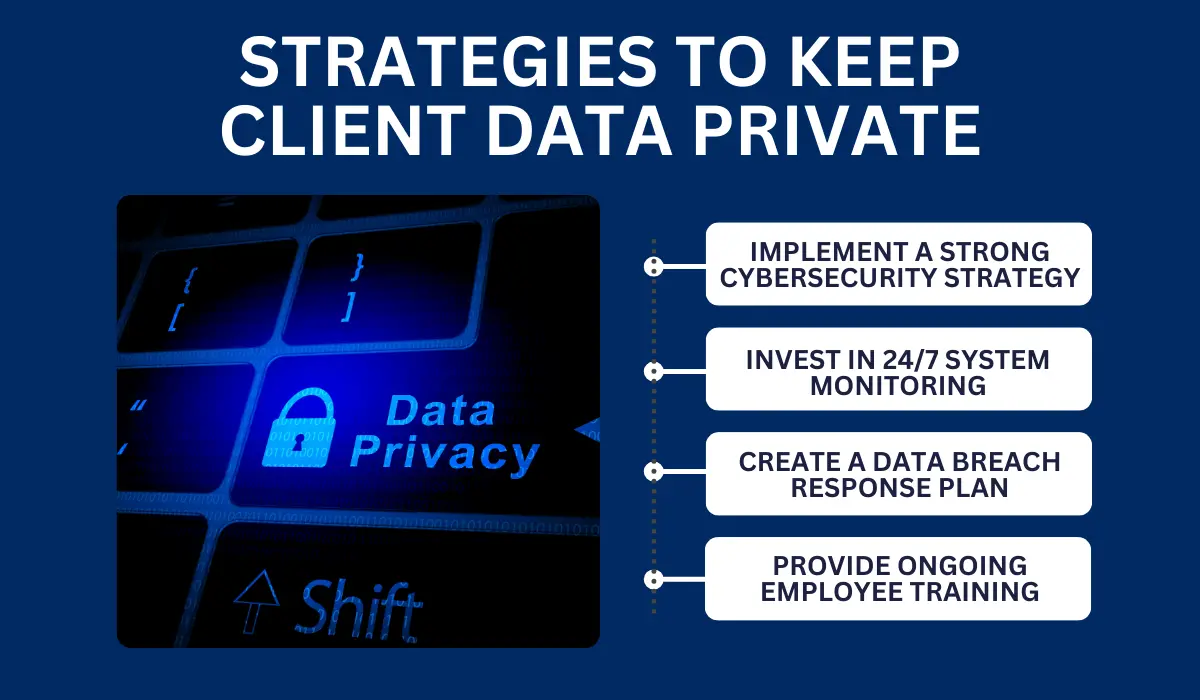

There are many strategies you can put in place to keep client data private and avoid compliance risks. These include:

- Implementing a strong cybersecurity strategy: Work with IT professionals to put cybersecurity defenses in place for your systems. This could include implementing firewalls, installing antivirus software, and setting up a robust access management strategy for your team.

- Investing in 24/7 system monitoring: Ongoing system monitoring will help you catch potential vulnerabilities or system breaches as soon as they happen. This will help you respond faster and reduce damage to your systems.

- Creating a data breach response plan: Having a response plan in place will help you act quickly in the event of an emergency, which can help minimize data loss, reduce downtime, and limit overall damage to your firm.

- Providing ongoing employee training: New cyber threats and privacy concerns arise frequently. Offer regular training sessions for your staff members to help them understand cybersecurity best practices.

Why is Employee Training Important?

Regular cybersecurity training is a must for your employees, regardless of their role in the firm. Not only is it necessary for some compliance requirements, but it can also help you prevent devastating data breaches.

Today, many law firm operations are handled online, from basic administrative tasks to complex case management. While technology has made many law firm operations more efficient, it also comes with some unique security risks.

Without proper training, it’s possible for your employees to accidentally expose your client data and put your firm at risk.

For example, law firms are often targeted by phishing email scams, which is when a cyber criminal poses as a trusted contact in an attempt to gain access to your data.

Hosting regular training sessions will help your employee learn how to spot potential privacy breaches and other forms of criminal activity. This will help your staff serve as the first line of defense against data breaches.

How Can Tech Advisors Help Your Law Firm?

Many law firms don’t have the time or resources to handle IT and compliance issues in-house. This is where a managed IT services provider comes in.

Tech Advisors provides IT, cybersecurity, and compliance support for law firms. Our experts can help you create and implement a security strategy that keeps your client data private.

We serve as your third-party IT consultant, providing support for everything from system monitoring to emergency response to employee training.