Imagine it’s April 14. You’re knee-deep in last-minute returns, racing the clock. A client has just emailed an updated 1099, and your team is juggling multiple tabs, spreadsheets, and software windows to finish the job. Suddenly, your system freezes. A phishing link from earlier has triggered ransomware and is now holding your files hostage. The clock is ticking, deadlines are looming, and your clients depend on you.

Think this sounds extreme? It’s not. Cyberattacks on accounting firms have surged 300% since the COVID-19 pandemic began. That statistic is staggering, but what’s even more alarming is how many of those attacks succeed simply because the firm’s software wasn’t up to date.

If you’re a managing partner, operations lead, or the go-to IT decision-maker at your firm, you’re probably not ignoring updates on purpose. You’re just trying to run a business, meet client expectations, close books, and deliver value. The problem is, outdated accounting software doesn’t just slow you down. It opens the door to threats, disrupts bookkeeping, and leaves your team scrambling when things should run smoothly.

Software updates aren’t just technical maintenance. They directly invest in your security, compliance, and client trust. They prevent costly downtime, align you with tax law changes, and unlock features that make your staff’s work easier and more accurate.

In this article, we’ll walk you through ten specific, business-critical reasons to prioritize updates and show you how to make them part of your firm’s rhythm without sacrificing productivity. If your goal is to stay competitive, reduce risk, and future-proof your systems, this is the checklist you didn’t know you needed. Let’s get into it.

Key takeaways

- Treat software updates as business insurance, not a tech chore. Delaying updates invites cyber threats and jeopardizes your ability to deliver on client deadlines, maintain compliance, and protect revenue streams.

- Your firm’s credibility hinges on your tech hygiene. Clients notice when you’re running outdated tools, and it silently undermines trust, especially when they’re trusting you with sensitive financial data.

- Regulations shift constantly; only current systems can keep pace. IRS changes, GAAP revisions, and FASB rules are baked into update cycles, meaning every skipped patch increases the risk of non-compliance.

- Manual updates are a liability; automate and offload to reduce human error. Integrate auto-updates for core systems and lean on trusted IT partners to handle version control, testing, and backups without interrupting workflows.

- Future-proofing starts with staying current. Falling behind on updates today blocks you from adopting tomorrow’s tools, like AI-driven forecasting and real-time reporting, that your competitors are already exploring.

The foundational need for software updates

A software update is a vendor-issued patch, fix, or upgrade that improves functionality, plugs security holes, and refines user experience. In a modern accounting system, those updates carry extra weight because you daily handle Social Security numbers, bank details, and confidential financial data.

Outdated programs create vulnerabilities that attackers exploit, slow performance that frustrates bookkeeping staff, and compatibility issues that break integrations with cloud-based reporting tools or Excel add-ins. In short, skipping updates risks data breaches, missed deadlines, and unhappy clients.

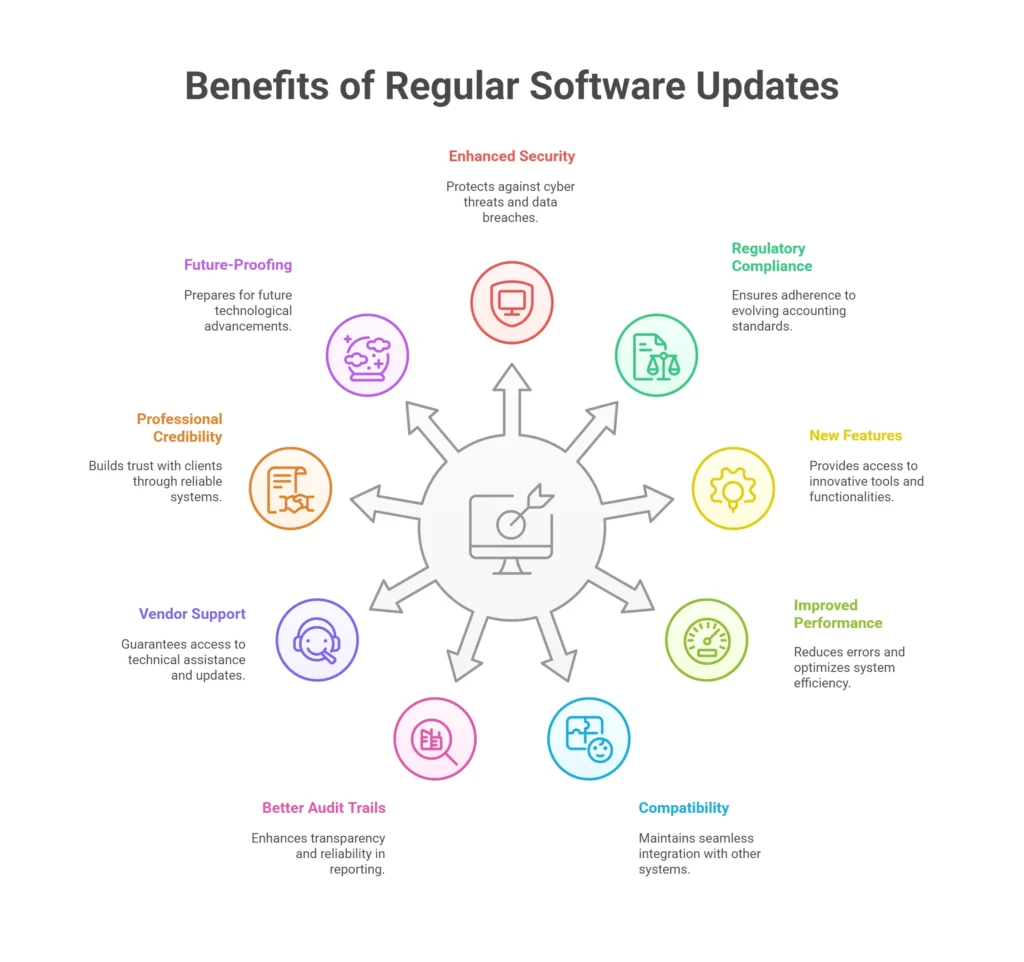

9 crucial reasons accountants need regular software updates

You’re not just running behind if your firm relies on outdated software. You’re risking client data, compliance, and reputation. These ten reasons show why regular updates are essential to a secure, competitive, and future-ready accounting practice.

1. Security and Threat Protection

Cybercriminals exploit outdated software to access sensitive data—client tax IDs, bank accounts, payroll records. Timely updates close those gaps, blocking malware, ransomware, and phishing attempts before they hit.

Updates also defend against emerging threats, as attackers constantly evolve their tactics. They evolve daily, matching the pace of software vendors and sometimes moving faster. Static defenses can’t keep up. Without regular updates, your systems are blind to zero-day exploits and modern attack patterns.

According to the World Economic Forum’s Global Cybersecurity Outlook 2025, 72% of executives and cybersecurity leaders say cyber risks have increased in the past year. Despite that, many accounting firms still delay critical updates, exposing their systems when the stakes have never been higher.

Bottom line: To protect your data, clients, and credibility, staying updated is essential.

2. Ensuring regulatory compliance

Tax codes, IRS forms, GAAP, and FASB rules evolve rapidly. Vendors embed the latest accounting standards into updates, so you avoid non-compliance penalties and embarrassing restatements of financial statements. Many platforms push automatic updates as laws change, removing the need to track every bulletin manually.

3. Access to new features and enhancements

Updates add features that reduce manual data entry, flag discrepancies, and deliver richer financial reporting. Think AI-driven forecasting or one-click cash-flow dashboards. Practices that adopt multiple cloud features are 75% more likely to boost profit than those using just one tool. Better tools lead to smoother workflows and happier team members.

4. Improved performance and stability

Bugs cause crashes, slow load times, and lost work. Patches refine code, reduce errors, and optimize software development choices that impact day-to-day tasks like bookkeeping and reconciling accounts payable. Faster systems keep you on schedule and eliminate client-deadline anxiety.

5. Enhanced compatibility with other systems

Your practice relies on CRM data, payroll feeds, bank APIs, and QuickBooks imports. Updates ensure your accounting software remains compatible with Windows, macOS, and critical third-party integrations, preventing broken connections and duplicate data.

6. Better audit trails and reporting

Auditors and stakeholders demand transparent logs and trustworthy metrics. Update cycles often extend audit-trail depth, add immutable change records, and improve customizable financial reporting templates. Strong trails equal smoother audits and fewer surprises.

7. Maintaining vendor support

Most vendors support only current or recent versions. Staying current guarantees access to technical help, critical hot-fixes, and warranty protections. If you lag, you may face extra fees or no help when an urgent bug appears.

8. Professional credibility and client trust

Updated tools show clients you take security and compliance seriously. By contrast, outdated, buggy systems erode confidence, risking churn. Security breaches tied to obsolete software can drive clients away and erode profitability.

9. Future-proofing your practice

Routine updates position you to adopt next-gen AI analytics, cash-flow prediction, and cloud-based collaboration. ACCSA Global reports that 43% of firms buy new software chiefly for added functionality. Staying current keeps your practice agile as tech and small businesses evolve.

Practical tips for implementing regular updates

Why execution matters as much as intent

Understanding the importance of software updates is one thing. Putting a system in place to ensure they happen is another. Too often, firms know they should update but end up postponing because of workload, uncertainty, or fear of downtime. The result? Missed patches, mounting risk, and preventable tech issues at the worst possible moments.

If you’re a managing partner, firm administrator, or operations lead, the key is to treat updates like any other essential workflow. A few smart changes can make updates painless and automatic. These five practical tips will help you protect your accounting software, maintain uptime, and keep your financial data secure, without slowing down your team.

1. Automate updates whenever possible

Take advantage of built-in automation settings in your operating systems, browsers, and cloud-based accounting software. Most reputable vendors release security patches and new features on a regular cadence. Enabling auto-updates ensures you never miss a critical patch, especially those that protect against emerging cyber threats, and reduces the need for manual oversight.

2. Schedule strategically

Not all updates should run during business hours. To avoid disrupting active bookkeeping tasks, schedule non-urgent patches outside peak times, early morning, evenings, or weekends work best. Set recurring calendar reminders or integrate your patch schedule with firm-wide IT policies. The goal is consistency, not chaos.

3. Test in a staging environment

For larger firms or those with complex tech stacks, especially when custom CRM integrations or sensitive financial reporting tools are in play, always test updates in a sandbox first. This staging environment acts as a safety net, allowing your IT team to identify issues before they affect production systems or client-facing workflows.

4. Maintain reliable backups

Before installing major updates, fully back up your systems, files, and databases. If something goes wrong, a snapshot protects your client records, cash flow forecasts, and financial statements. Backups should be automated, encrypted, and stored locally and in the cloud for redundancy.

5. Seek professional IT support

If managing software updates is draining your internal resources or distracting from client work, it’s time to outsource. At TechAdvisors, we specialize in supporting accounting professionals with proactive update management, integration testing, and training for your team members. That way, you get the benefit of a secure, updated environment without the distraction of having to manage it yourself.

Want updates that just work, without the stress? Let us handle it.

Conclusion

Regular software updates protect everything your firm stands for: client trust, compliance, and operational efficiency. Falling behind puts your accounting software, sensitive financial data, and hard-earned reputation at risk.

If you’re leading a busy firm, you don’t have time for preventable tech failures or regulatory surprises. That’s where we come in.

At TechAdvisors, we partner with accounting professionals to take the guesswork out of IT. We’ll help you implement timely updates, eliminate vulnerabilities, and create a seamless environment your team can rely on, tax season or not.

Ready to make software updates the least of your worries? Let’s talk about how to simplify your update process. Schedule your free consultation and take the first step toward a smarter, safer, more resilient accounting practice.